Planned giving: A nonprofit's guide to growing legacy gifts

Every nonprofit needs a strategy for long-term sustainability, and planned giving is the answer.

Over the next 25 years, an estimated $68 trillion will be transferred as Baby Boomers pass on their wealth. That’s the largest wealth transfer in human history and a massive opportunity for philanthropy.

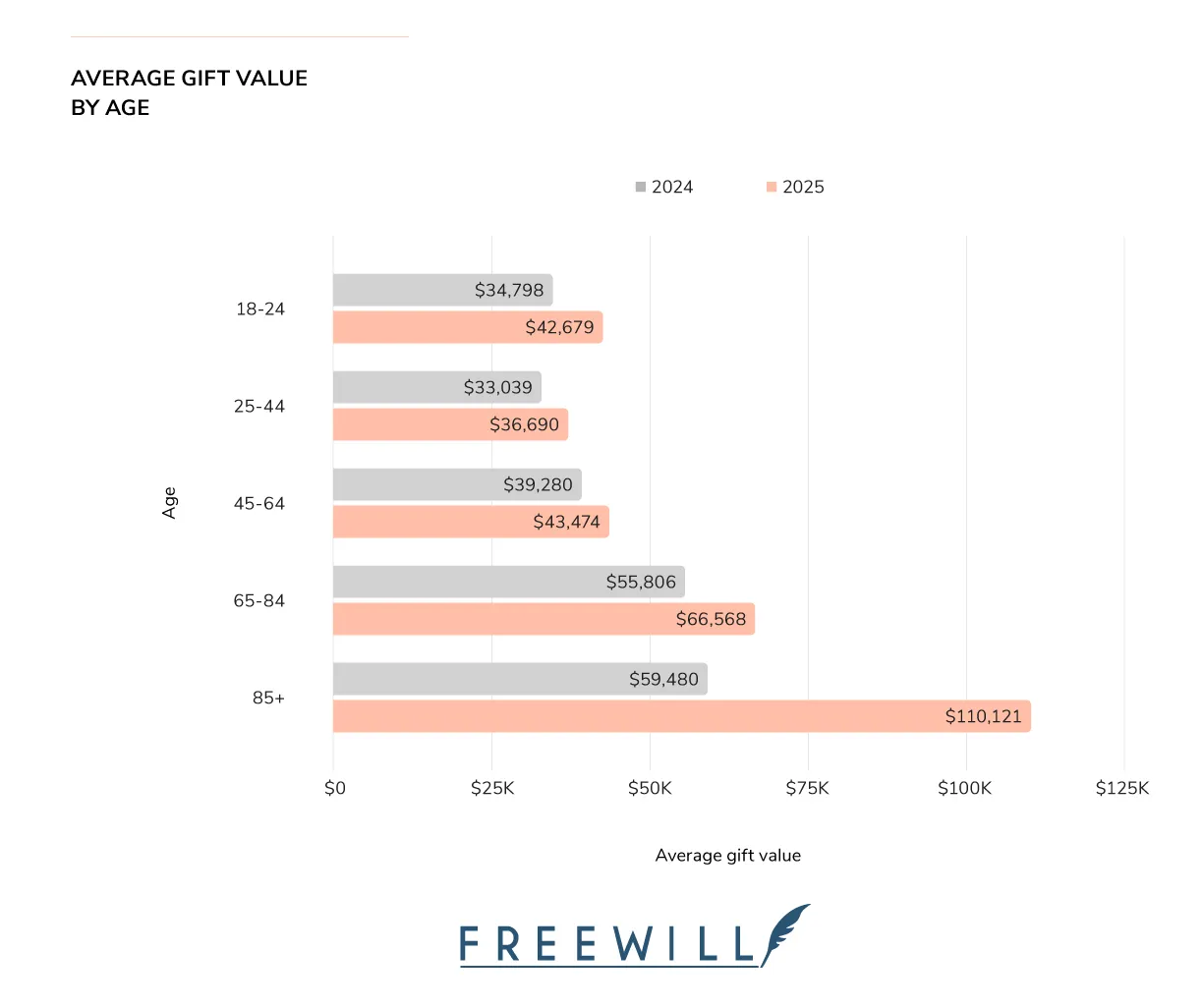

Planned giving isn’t just for older donors either. At FreeWill, we’ve seen rising interest across all age groups, with the average bequest increasing by 15% in 2024, and bequests accounting for 8% of charitable giving that year. Even donors aged 18-24 are creating bequests with average gifts exceeding $42,000. For donors aged 85 and above, that number skyrockets to $110,000.

By cultivating relationships now and making it easy for supporters to include your organization in their wills, your nonprofit can tap into one of the biggest moments for planned giving ever.

In this guide, we’ll cover what legacy giving is, why it matters, and how to launch a sustainable planned giving program for your nonprofit!

Understanding the basics of planned giving

Planned giving, also called legacy giving, is the practice of donors committing to charitable contributions as part of their financial or estate planning. These gifts often take effect after a donor’s lifetime, as the donor might name the nonprofit as a beneficiary in their will, retirement plan, or life insurance policy. However, planned gifts can also include vehicles like charitable gift annuities or trusts. Donors often give this way to make a lasting impact on a meaningful cause while also receiving tax savings.

What is the most common type of planned gift?

While there are a few different ways to give via planned giving, bequests are by far the most popular and easiest type of planned gift. Bequests are left in a donor’s trust, will, or estate plan and given to a nonprofit upon the donor's passing.

Bequests are actually one of the top charitable giving methods, accounting for $45.84 billion last year, falling only behind individual and foundation giving. While bequest giving fluctuates and dropped by 1.6% last year, the average bequest size made through the FreeWill platform actually increased by 15% to $48,723.

How do nonprofits secure new planned gifts?

Nonprofits create and operate planned giving programs to grow their number of planned gifts and support the future of their organizations. Today, nonprofits commonly use dedicated Planned Giving Microsites to promote programs and facilitate gifts.

Planned giving officers build relationships with prospective and current planned giving donors. Because planned gifts can often take years to materialize and donors may revise their wills over time, it’s essential for organizations to keep in touch with these donors and remind them of the impact of their gifts.

What are common planned giving terms?

Beyond the specific types of planned gifts, there are a few key terms worth knowing when launching your program. Learning them will make it easier to communicate with legacy donors:

- Bequest intention (or bequest commitment): A donor’s documented promise to leave a gift through their estate, even though it may not be legally binding until the estate is settled.

- Planned gift notification: When a donor informs a nonprofit of their intention to leave a planned gift, it leaves room for the nonprofit to steward that relationship during the donor’s lifetime.

- Contingent bequest: A gift that only goes to the nonprofit if certain conditions are met (e.g., a primary heir predeceases the donor).

- Bequest expectancy: The estimated future value of a nonprofit’s planned giving pipeline, based on commitments received.

- Legacy society: A recognition group created by a nonprofit to honor donors who have committed planned gifts.

Mastering these core planned giving terms, among others, helps your nonprofit speak the same language as donors and advisors, laying the foundation for trust and clarity. Consider building an internal glossary or incorporating these terms into staff training so everyone feels equipped to steward planned gifts with confidence.

What types of nonprofits are most successful with planned gifts?

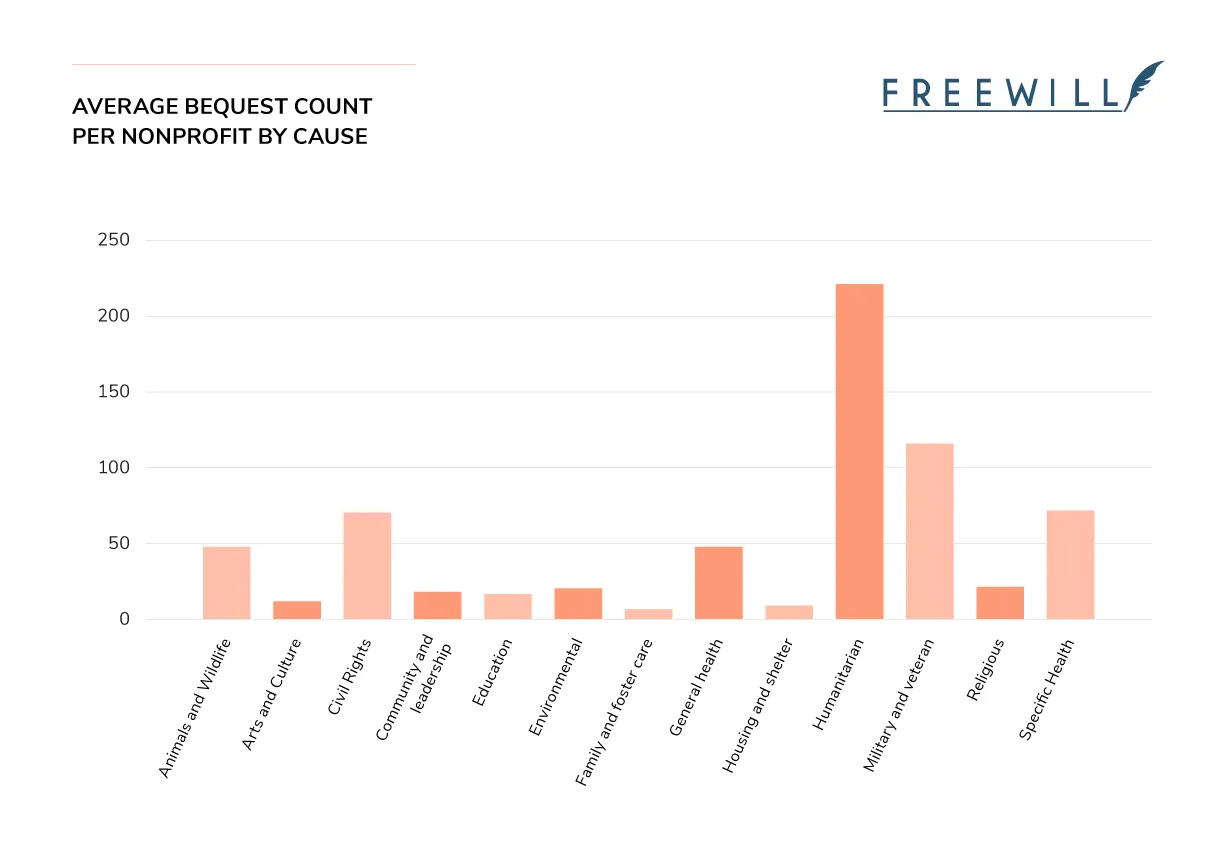

Nonprofits of all missions and sizes with active donor bases can succeed with planned gifts. Our research shows that some cause areas see especially strong results, either through larger average bequests or a higher number of gifts overall:

- Education organizations lead the way, with the largest average bequests at nearly $70,000.

- Animals & Wildlife ($43,600) and Civil Rights ($34,100) also inspire legacy gifts that are well above average.

- Health, humanitarian, and religious causes see average gifts in the $20,000-$30,000 range.

- Arts, culture, and community groups typically receive smaller gifts, but often benefit from donor loyalty and frequent bequests.

See the chart below for the number of bequests by cause area. This is a great reminder that volume matters just as much as gift size:

Regardless of your mission, an active donor base can generate lasting legacy support. But if you’re in a sector with historically higher averages, lean into that strength when cultivating planned gifts.

Who gives planned gifts to nonprofits?

Major donors contribute the largest planned gifts to nonprofits and are more likely to express interest in complex giving arrangements beyond simple bequests. However, donors at all giving levels can make valuable prospects.

Our most recent Planned Giving Report uncovered some interesting findings:

- Women are more likely to include a bequest in their wills (57% of estate plans vs. 42% for men), but men give larger gifts on average ($73,434 vs. $52,250 for women).

- Single donors contribute the majority of planned giving dollars (62%) and leave the largest average bequests ($76,677).

- Married donors represent more wills, but a smaller share of total dollars (34%).

- Donors without children drive 64% of giving dollars and give gifts about 2.5x larger than those with children

- Pet owners are more charitable: 21% include a bequest vs. 13% of non–pet owners

After all, can easily create a bequest (particularly using free online tools like FreeWill). Planned giving commonly helps nonprofits uncover opportunities that they’d otherwise miss, such as casual donors who commit mid-level bequest gifts or mid-level donors who unexpectedly leave the equivalent of a major gift in their wills.

The benefits of planned giving for nonprofits

If you want to invest in your organization’s capacity for planned giving, you’ll need to be able to make the case to your leadership. Planned giving has a major impact on how an organization plans for its future and sustains itself in the long run. Here are three key benefits that nonprofits receive from planned giving programs:

1. Planned giving opens up a pool of untapped revenue.

Because planned gifts don’t affect a donor’s everyday cash flow, they’re accessible to everyone. That includes everyone from those whose incomes rarely permit them to give to major donors who give generous annual gifts. While most planned giving officers focus on cultivating relationships with top donors, research from our founders actually shows that frugal donors who are lifelong savers are often in the best position to give large bequests.

2. Planned gifts help secure an organization's future.

The average gift size from a will-maker on FreeWill is quite high, consistently above $30,000 for younger donor segments and above $55,000 for older cohorts. These large gifts create a consistent source of funding and support for nonprofits, even during times of economic crisis or losses in annual giving.

Keep in mind that recent changes to the U.S. tax code have made securing planned gifts even more essential. An increase in standard deductions leaves fewer Americans able to itemize deductions on their tax returns. Since 2018, higher standard deductions mean fewer Americans itemize charitable gifts on their tax returns. In 2024, this shift led to the first year-over-year decline in charitable giving from individuals in many years. Planned gifts help nonprofits offset these losses by providing reliable, long-term support that isn’t tied to annual fundraising.

3. Planned giving increases annual giving.

Planned giving is generally thought to be at the top of the traditional donor pyramid—secured after donors give major gifts. Even planned giving officers are often a part of the major gifts team at their organizations, adopting the tools of that discipline: identifying top prospects, meeting with them in person, and then gradually securing bequest commitments. But this isn’t always the best practice.

Planned giving has been shown to increase annual giving from donors who create bequests, effectively inverting the traditional donor pyramid. It has proven to be a viable and effective way to engage donors at all giving levels.

Russell James, a Texas Tech professor and planned giving expert, conducted an in-depth analysis of charitable giving in 2014. He found that donors who left a charitable bequest in their will increased their average annual giving by more than $3,000.

How donors benefit from planned gifts

Donors also see unique benefits from creating bequests and other planned gifts. When you understand these benefits and the motivations behind them, planned giving becomes much easier to pitch to supporters. Emphasize these benefits when discussing planned giving with your donors:

1. Planned giving allows donors to leave a legacy.

Planned gifts allow donors to make a lasting impact beyond their lifetimes. For long-time supporters, a bequest is a powerful way to preserve their legacy with an organization they care about. Even donors who couldn’t give large gifts during their lifetimes can ensure their values live on by supporting your mission through their estate.

2. Donors can decide how their planned gifts are used.

With a planned gift, donors decide how their contribution will be used — whether for a specific program, endowment, or unrestricted support. Because wills and other estate plans are relatively easy to update, donors also have the flexibility to adjust their planned gifts as their priorities change, ensuring their legacy has the greatest impact.

3. Planned gifts can provide significant tax advantages.

Depending on the type of planned gift a donor makes, they can claim tax deductions. Bequests can reduce federal estate taxes for heirs, and these deductions aren’t limited to cash. They can include assets like real estate, IRAs, and stock. The IRS grants some other types of planned gifts, such as charitable remainder trusts, tax-exempt status.

While the tax benefits can be substantial, donors should consult financial or tax professionals for personalized guidance.

4. Planned giving offers financial flexibility.

Planned gifts are highly adaptable giving vehicles. They can involve a mix of cash, securities, or other assets and can be structured to meet donors’ needs. For example, charitable remainder trusts can provide donors with income during retirement while still ensuring a gift to the nonprofit. This flexibility makes planned giving a valuable tool for donors at all wealth levels.

The most common types of planned gifts

Planned gifts generally fall into a few categories: outright gifts of cash or non-cash assets, gifts that pay income back to the donor, and more complex gifts that protect or retain a donor’s assets. Within these categories, several popular types of planned gifts stand out:

- Bequests: These ‘outright’ gifts are left as a bequest in a legal will, given as a specific amount or portion of a donor’s estate.

- Charitable gift annuities: Annuities allow donors to give large amounts of cash or assets in exchange for a fixed income payment according to the agreement’s terms, with the organization keeping leftover funds and, typically, income generated through investment.

- Charitable remainder trusts: Trusts can take several forms, but generally involve the nonprofit receiving its remaining value after the trust’s term ends. A charitable remainder annuity trust pays the donor a fixed amount based on the initial fund assets, while a charitable remainder unitrust pays the donor a percentage of the principal that’s revalued annually.

- Charitable lead trusts: A lead trust pays the donor an income to the nonprofit according to the agreement’s terms, with the remaining funds returning to the donor or their heirs.

Nonprofits increasingly include non-cash giving in their planned giving programs, as well. Gifts of stock, real estate, QCDs from IRAs, cryptocurrency, DAF grants, and pooled income funds all offer flexible ways to meet donors’ needs and expectations.

The various types of planned gifts can get complicated, and there are many more to explore. Refer to our complete guide to the types of planned gifts to learn more.

A checklist to know if your nonprofit is ready for a planned giving program

Before investing time and resources, take a step back and make sure the foundation is in place to support a planned giving program at your nonprofit. Use this simple checklist to determine whether your nonprofit is positioned for success:

- You already have a strong major gifts program. Planned giving naturally builds upon the systems, relationships, and culture you’ve developed through major giving.

- You have a core group of committed supporters. Many of your donors have given regularly over the years, showing loyalty and trust in your mission.

- Your nonprofit will be around for years to come. With a clear vision and history of stability, donors can feel confident that their legacy will be honored well into the future.

- You have the right systems and processes in place. From donor databases to legacy gift acceptance tools, your team can track interactions, acknowledge gifts, and manage documentation.

- Your organization can handle complexity. Whether through in-house staff or trusted partners, you’re prepared to navigate the legal, tax, and administrative details that come with planned gifts.

If your organization meets most of these criteria, you’re likely ready to launch a planned giving program and start building a legacy pipeline. If not, spend some time strengthening your donor base and infrastructure, so you’re ready when the time is right.

How to get started with planned giving

If your organization wants to prioritize planned giving, there are a few steps you should follow to kick off your efforts successfully.

For a full walkthrough of the recommended practices and resources you’ll need, check out our full guide to creating a planned giving program. Here are the must-knows to get you started:

Step 1: Unify your teams.

Before you start a planned giving program, everyone at your nonprofit should be on board. Secure buy-in and determine where this program will fit within your organization’s existing infrastructure. Answer these questions:

- Will planned giving be part of the major gifts department? Will it have its own department? Who will take the lead in managing it?

- Will your organization hire an expert or train an existing staff member to source, secure, and steward planned gifts?

- What resources will your organization allocate to increasing or marketing planned gifts?

However your organization decides to approach planned giving, ensure that your development and communications teams are aligned about marketing planned giving to your supporters. These teams should create shared goals and balance any competing priorities to identify key moments to solicit supporters and fundraise for your organization.

Step 2: Invest in tools to track and manage planned gifts.

Team members in charge of running your planned giving program will need the right tools that empower them to succeed. Effective planned gift fundraising and stewardship require:

- A CRM or database that can track individual engagement and donation data and has moves management capabilities

- Marketing collateral and resources for one-on-one discussions with donors

- A Planned Giving Microsite to serve as the program's digital home

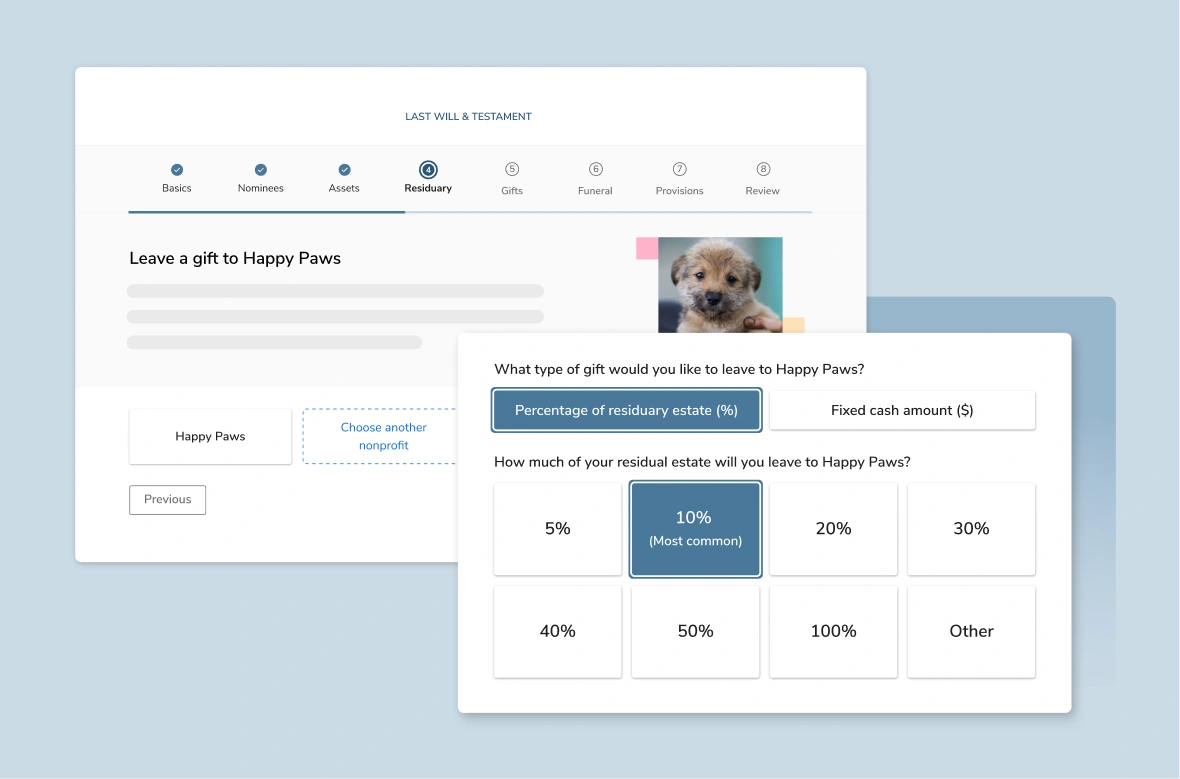

- Donor-facing estate planning tools and resources to simplify the process of creating planned gifts

If you already have a robust development program in place, your organization is likely familiar with moves management, ongoing donor stewardship, and how to use a CRM for these purposes. Planned giving requires a similar approach, but truly exceeds when you can make your asks as easy as possible for donors to complete—FreeWill can help.

How FreeWill supports your nonprofit’s planned giving program

FreeWill provides donors with an easy, completely free way to create their own wills and leave bequests to your nonprofit.

Estate plans made on our platform are five times more likely to include bequests, and these gifts are more than twice as large as the national average. Backed by our tools, empower your donors to create their free wills, encourage them to create a bequest, and begin securing new planned gifts.

Learn more about our complete set of planned giving tools or explore other success stories to see how organizations have built thriving planned giving programs!

Step 3: Identify initial planned giving prospects.

Develop an initial outreach list for your development team by following these prospecting best practices:

- Review trends and common demographics among planned gift donors using industry reports like our Planned Giving Report.

- Send an initial survey to a broad segment of your donors to gauge familiarity with and interest in planned giving.

- Create donor profiles or personas based on your research, survey findings, and data about any existing planned gift donors to your organization.

- In your donor database, hone in on your donor personas, then screen these groups by giving affinity and capacity as you would for typical prospecting.

- Work your way through your initial outreach list, record touchpoints, and identify trends.

This foundational process will help you get started, but don’t constrict your scope too narrowly over time. Planned gifts are highly accessible and popular among donors at all giving levels, so focusing your prospecting solely on high-wealth donors will likely limit your results.

Instead, take a dynamic and iterative approach. Learn over time and adapt your prospecting practices as new trends and opportunities emerge. Broader marketing of your program ensures you cover your bases and boost its general visibility.

Step 4: Outline your marketing plan.

Just like communicating to your supporters about any other fundraising options or campaigns, repetition and ease are key for marketing planned giving.

First, make it incredibly easy for supporters to find and access this new way to give. Add planned giving as a donation option on your website, or create a dedicated landing page or website to explain all the ways a donor can make a planned gift. Give them resources that make it easy to leave a bequest, such as making a will through FreeWill, or offer them support by giving them a person at your organization to contact for more information.

Then, create marketing materials such as emails and direct mail to inform your donors about the impact and benefits of planned gifts. Identify the best marketing channels for planned giving, and add a few planned giving campaigns and informational events to your organization’s annual communications calendar.

Once your program is set up, actively gather insights from both your direct prospect outreach and engagement with marketing materials. Together, they’ll give you a full picture of your donor base’s interest in planned giving and reveal new insights over time.

Step 5: Acknowledge legacy donors.

Planned gifts, and especially bequests left in a will, can be difficult to track. Some organizations occasionally survey their supporters to see if there are any donors who have left bequests and forgotten to notify them. When you do learn about a planned gift, make sure you thank the donor and acknowledge the impact their gift will have on your organization’s mission.

If you set up a legacy society with any special perks, such as public acknowledgments, access to special events, or organizational communications, make sure you invite donors to take part. Doing so will help make the donors feel like a part of the community and strengthen their relationship with your organization.

These foundational steps will help you establish a solid planned giving program that you can improve and grow over time, but remember that success takes a sustained investment of your time. Planned giving pays off and generates a high ROI for nonprofits, but you’ll need to devote attention and resources to it—even just an hour or two a week at first will pay dividends.

Common planned giving pitfalls

As you begin securing planned gifts for your mission, stay aware of these common pitfalls:

- Passively waiting to receive bequests: You’ll need to actively solicit planned gifts to see results. Donors also technically don’t need to tell you when they’ve created a bequest. You might receive a surprise gift, but you completely missed the chance to thank and steward that donor during their lifetime. Avoid this missed opportunity by using FreeWill to facilitate planned gifts and receive automatic notifications of new gifts.

- Losing touch with committed donors: Bequest donors can change their wills at any time. It’s on you to stay in touch through ongoing stewardship, legacy societies, and more.

- Not collecting the data you need: Along with maintaining relationships, you’ll need to keep track of all your program’s relevant data over time. Create an intentional process for recording and analyzing your program’s performance in your CRM. Use planned giving tools that generate and report data for you to reduce any gaps.

- Missing the full range of donor motivations: Donors give planned gifts for all kinds of nuanced reasons. Talking about planned giving can be tricky at first, but it’s much easier when you can confidently speak to and address donors’ motivations. Legacy-building, tax benefits, estate planning, and more can all come into play.

- Failing to demonstrate social proof: Testimonials from other donors go a long way in convincing prospects to make planned gifts to your organization. Use quotes and photos on your website. Publicize your legacy society, and invite prospects to join your next special event or estate planning seminar. Show them the thriving community of supporters who’ve chosen to give in such a meaningful way.

Looking ahead: How planned giving fuels long-term growth

Due to both demographic trends and the rising importance of diverse types of gifts, planned giving is currently a major topic of conversation for nonprofits of all sizes. Wealthy donors increasingly prefer to give via DAF grants and stock donations as they fine-tune their philanthropic strategies to maximize impact and tax benefits.

Planned giving offers an ideal way to help your organization expand into these new forms of fundraising. Here’s why:

- Planned giving starts conversations about estate and financial planning that otherwise might not come up, creating natural opportunities to discuss various non-cash and in-kind donations when prospects express interest.

- Planned giving expands your team’s knowledge, both in terms of more financially complex gifts and in how to guide more nuanced cultivation and solicitation journeys with prospective donors.

- Planned giving creates a great impression of your organization as dynamic, forward-looking, and appreciative of its deep relationships with donors—qualities that many funders and DAF grantors look for!

Remember, take an iterative approach. Planned giving is a highly productive way to elevate your nonprofit’s fundraising practices, but there’s no need to rush. Improve your approach and giving programs piece by piece as you learn more about your donors and their preferences. The right tools will make this process much easier.

Planned giving resources and knowledge base

Ready to learn more about planned giving and how to secure planned gifts? Or do you have more questions about specific topics discussed above? Browse our library of nonprofit resources full of best practices and examples to help you succeed with planned and major giving.

Here are a few highlights that newcomers to planned giving will find especially helpful:

- Types of planned gifts your nonprofit should know

- What are charitable bequests for nonprofits?

- How to start a planned giving program: Step-by-step guide

- The benefits of planned giving for nonprofits and donors

- Planned giving marketing: 7 strategies and ideas you need

- Make-A-Will Month: 3 tips to boost planned giving

- Planned giving for churches: How to build legacy & community

Ready to kick-start your planned giving program? FreeWill can help! Let’s discuss your goals and lay out a way to build a next-level legacy for your mission.

How the country's leading nonprofits launched planned giving programs at their organizations.

How the country's leading nonprofits launched planned giving programs at their organizations.